At-A-Look

A great Va financial offers professionals eg lower interest levels, no need having private mortgage insurance, potentially zero deposit, and.

Along with the fresh mortgage loans, Virtual assistant loans can be used for cash-aside otherwise all the way down rate of interest refinancing, in the event you already taken out a beneficial Virtual assistant loan on prior.

The us authorities developed the Va financing system more than 75 years back to simply help experts buy sensible casing. Having 2021 an archive-cracking seasons for Virtual assistant finance, both to find house and to refinance, the program stays a significant capital to have qualified applicants. step 1 But exactly how precisely perform Va finance performs, and you may whom qualifies?

Just how an excellent Virtual https://elitecashadvance.com/installment-loans-il/magnolia/ assistant Home loan Performs

Of many borrowers thought a great Virtual assistant financing merely a primary mortgage about regulators. Indeed, the fresh Va generally promises only elements of the borrowed funds so you can a great separate lender, tend to a lender, borrowing from the bank lender, otherwise mortgage company. The lending company also offers its own mortgage terminology given that Virtual assistant provides since a good backer, promising no less than a limited benefits when your mortgage would be to standard. On support of one’s Va, loan providers feel hotter providing borrowers cost-rescuing financing words.

Immediately after qualifying, qualified individuals located a certification out of Qualifications (COE) on the Va. So it COE will be found in a profile along with other information usually provided to a personal home loan company when submitting a loan application, such as income, bills, and you can credit reports.

The key benefits of a beneficial Va Financial

In the event qualified Virtual assistant mortgage candidates can still be using a beneficial conventional financial because of their financial, a great Virtual assistant mortgage has several advantage on other lenders. dos Popular pros is:

- Zero or low-down repayments: Of several Va-backed money do not require a downpayment. However, some loan providers may need you to, especially for higher priced services.

- Zero personal financial insurance requisite: Of a lot lower if any deposit financing wanted individual home loan insurance policies (PMI), but a great Virtual assistant loan doesn’t, that can decrease the monthly cost of a great Virtual assistant mortgage.

- Zero minimum credit history in order to be considered: The fresh Virtual assistant doesn’t need the very least credit score to acquire a beneficial Virtual assistant mortgage. Your credit score are still an integral part of a good Va loan reputation and will hence determine mortgage terminology, nevertheless Virtual assistant need loan providers to get into any application besides your get before you make a last choice and you may function conditions.

- Va recommendations: The fresh new Va keeps practices all over the country staffed to aid borrowers, whether or not they need assistance applying, recommendations when the they’ve fell behind to the repayments, or maybe just has questions in the length of the loan. 3

- Probably finest interest levels: The rate linked to a mortgage may vary depending on loan proportions, the new borrower’s monetary facts, and you may location. Normally, VA-supported loans generally have down interest levels than conventional financing. 4

Would We Qualify for a beneficial Va Mortgage?

There are a few groups that may qualify for a beneficial Virtual assistant financing. Of several eligible borrowers belong to certainly four categories:

- Veterans: Depending on after you served, length-of-solution standards differ, anywhere between ninety full days of effective solution so you’re able to twenty four continuing weeks. 5 If not meet up with the minimal productive-obligations solution requirements according to after you served, you might still have the ability to qualify for a beneficial COE if the you’re discharged for certain eligible grounds, instance impairment, a certain medical condition, or hardship.

- Active-duty service participants: For as long as you’ve been providing for at least ninety continuous months, you’re eligible for a great Virtual assistant loan.

- National Protect people: You can be eligible for a great Va loan if you’ve got during the minimum 3 months off low-studies effective-duty service, or was indeed honorably released or retired shortly after half a dozen creditable ages when you look at the new Federal Guard.

- Picked Put aside members: Picked Reservists is also be considered just after at the very least 3 months regarding low-knowledge energetic-obligation service, otherwise immediately after six creditable decades regarding the Chose Set-aside plus one of your adopting the: honorary discharge, later years, transfer to Standby Put aside once respectable services, otherwise continual services from the Chosen Reserve.

There are even official designs off Va money available to particular sets of qualifying people, including Local American veterans. Such Va fund will get hold additional positives, along with low interest, limited settlement costs, and no advance payment oftentimes. 7 To see if your qualify, you could potentially get your own COE from Virtual assistant eBenefits portal, using your lending company, or thru mail.

What Will cost you and you can Restrictions Are on good Va Loan?

Even with shorter can cost you, Va loans involve some costs and you can limitations. The latest specifics are different to the regards to the loan, many preferred will set you back and you can constraints are:

Articles récents

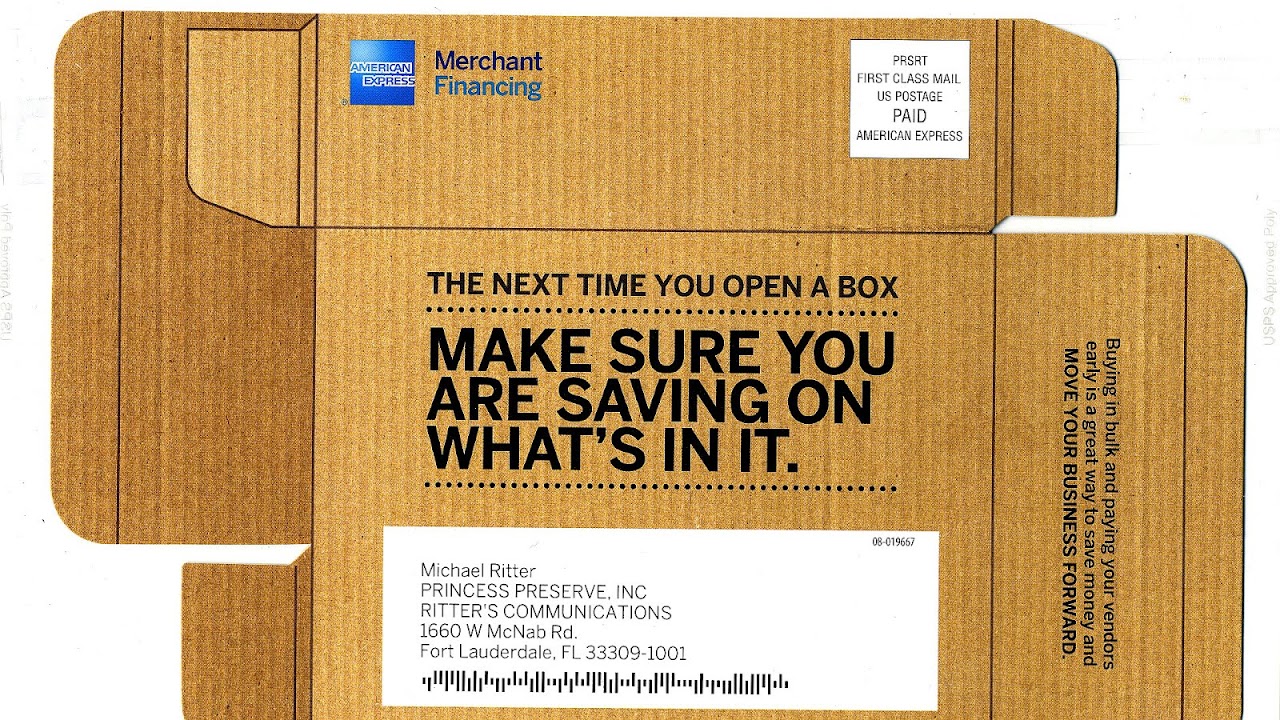

- We acquired a letter claiming I’ve up until to bucks they!

- A year ago, the fresh Agency extended its test system to keep track of the greatest nonbank participants on the education loan maintenance market

- Several other Round off PPP Loans Passed by Congress, Having But really Even more Changes for the Program

- How exactly to Be eligible for an excellent 0% Annual percentage rate Auto loan

- Friend Mortgage loan Financial Remark 2022: Easy Digital Procedure, However, Limited Mortgage Choices

Leave a Reply