Pocket Option Schedule: Maximize Your Trading Opportunities

Understanding the Pocket Option Schedule Pocket Option horario is fundamental for traders who want to maximize their opportunities in the financial markets. Whether you are a novice or an experienced trader, knowing the schedule allows you to plan your trades effectively and align them with market movements. In this article, we will delve into the various aspects of the Pocket Option Schedule, exploring its importance, structure, and how to make the most out of it.

What is Pocket Option?

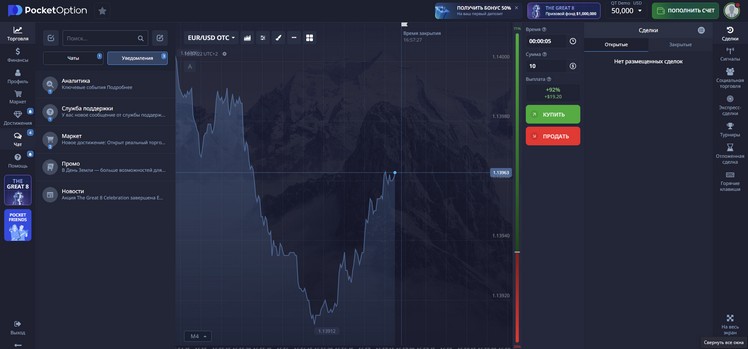

Pocket Option is a popular online trading platform that allows users to trade various financial instruments including currencies, cryptocurrencies, commodities, and stocks. Known for its user-friendly interface and range of tools, Pocket Option attracts both beginners and seasoned traders alike. One of the critical aspects of trading is timing, and that’s where the Pocket Option Schedule comes into play.

Understanding the Pocket Option Schedule

The Pocket Option Schedule outlines the available trading hours for different assets on the platform. Trading hours can greatly affect the volatility and liquidity of the markets, influencing potential trading outcomes. Moreover, being aware of the schedule helps traders strategically plan their activities during peak and off-peak times.

Why is the Schedule Important?

- Market Volatility: Different assets experience varying levels of volatility at different times. The schedule helps identify high volatility periods, allowing traders to capitalize on significant price movements.

- Liquidity: Active trading periods often have higher liquidity. Understanding when these times occur enables traders to enter and exit positions with minimal slippage.

- Market News and Events: Major economic news releases and events typically affect certain assets. Knowing the schedule aids traders in preparing for these announcements that can lead to price spikes.

Pocket Option Trading Hours

The trading hours on Pocket Option usually mirror the traditional trading hours of the underlying assets they provide. Most currency pairs are available for trading 24/5, allowing users to trade from Sunday evening to Friday evening, depending on the asset class. The cryptocurrency markets, however, typically operate 24/7.

Key Features of the Pocket Option Schedule

Some of the key features associated with the Pocket Option Schedule include:

- Flexible Trading Hours: Traders can choose to engage in trades at their convenience, allowing for flexibility around personal schedules.

- Real-Time Updates: The platform offers real-time updates regarding trading hours, ensuring that traders are always informed about market openings and closings.

- Access to Diverse Markets: The schedule includes multiple asset classes, enabling diversification and various trading strategies.

How to Use the Pocket Option Schedule

To make the best of the Pocket Option Schedule, traders need to consider the following strategies:

1. Align Trading Hours with Personal Schedules

It’s crucial to align the Pocket Option Schedule with trading strategies and personal commitments. If you are only available during specific hours, identify which asset classes are most active during those times.

2. Follow Market Trends

Stay updated with market trends, including regular and economic releases, and see how they correspond to the Pocket Option Schedule. This will enhance your ability to predict market movements more accurately.

3. Use Technical Analysis

Employ technical analysis, especially during active trading hours. Utilize charts and indicators to identify potential entry and exit points based on price movements that usually occur during those times.

Conclusion

In summary, the Pocket Option Schedule is an invaluable tool for traders looking to optimize their trading experience. Understanding the trading hours not only helps in strategizing effectively but also encourages traders to harness the market’s volatility and liquidity to their advantage. By employing strategies that align with the schedule, traders can enhance their performance and potentially increase their profitability in the competitive trading environment. Always stay informed and ready to adapt to the ever-changing market dynamics!

Leave a Reply